Main

This screen is used to define the type and frequency of the invoice, where it is to be sent and whether it is required to be printable or not.

Charge Templates can be created in two ways, manually or by using Skeleton Charge Templates. If you wish to make use of a previously created "Skeleton", click on the "Skel" button.

The "Choose Skeleton Charge Template" screen will appear.

Highlight the Skeleton you wish to use and click the "Load" button. This will add the predefined data to the Charge Template you can then add or edit the data as required. For more information on adding and editing please see the section below on manual creation of Charge Templates.

To create a new Charge Template manually click on the "Add" button (+) and then work through the fields as described below.

Select the "Invoice Type" from the drop down list, this is the list of different invoice layouts that have been set up in the Invoice Formats screen. The "Status" should be set to "Active" unless you do not want this Charge Template to be included in your invoice runs in which case change it to "Ignore". The "Issue Client Invoice" field defines the invoice cycle that is to be used and is selected from the list created in the Invoicing Periods screen. The "Funding Source" field defines which type of organisation or individual will pay for this invoice and is selected from the list created in the Funding Sources screen. The "Rate Type" field defines how the charge rate is to be calculated (i.e. on a weekly basis or daily basis, etc) this picks up the default rate that was set on the Resident Rate History screen but can be amended if necessary. The "Payment Method" field defines how this invoice is to be paid and is selected from the list created in the Sales Invoice Payment Methods screen.

The "Template Ref" field is automatically populated and is used in the process of Importing Variable Costs from Excel.

If you want invoices created from this Charge Template to be printable click in the "Printable Invoice?" box. If this box is not ticked invoices created from this template will not be printed out but invoice transactions will still be created and included in the posting to Sage 50 Accounts.

If you want this to be a Respite Care type of charge, the "Does this template contain respite care?" box must be ticked.

If you have purchased the Tradeshift Module and you want to be able to upload invoices from this template to Tradeshift, tick the "Upload to Tradeshift?" box.

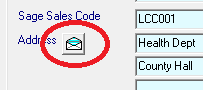

The "Sage Sales Code" field is linked to the list of Customer Account Codes in Sage 50 Accounts. Data in this drop down list will not be available until the Refresh Sage Data option has been run. When a Sage Sales Code is selected, any name and address information that is held in the Sage customer record will appear in the boxes below. N.B. If this needs to be amended it can be overwritten directly on this screen but it is better to correct the data in Sage 50 Accounts and then run the "Refresh Sage Data" option again and update the record.

If you wish to use a different address from the one that is recorded in the Sage Customer Account, you can override it by clicking on the Ad-Hoc Sales Addresses button.

Information typed into the "Comments" box will appear in the Comments section of invoices created from this template (you may need to check the invoice layout to make sure that there is a "Comments" field on it).

If you wish to be able to email invoices created from this template, an email address must be selected from the drop down list (these email addresses must have been entered into the Sage Customer Account records). You will also need to set up the relevant information on the "Invoice Emailing" tab of the System Defaults screen. For information on the process of emailing invoices go to Send Invoices by E-mail.

In addition, you may wish to password protect the PDF invoice files that you email. If so, enter the password in the "Password for Emailed PDF Invoices" box at the bottom of the screen. You will need to let the client know the password so that they can view the invoices they receive.

The two "Direct Debit CSV File Details" fields are used in conjunction with the Direct Debit File Output function. The "Ref" field is used to enter the reference you wish to use to identify your DD transaction (by default this will be the internal CareMaster reference number for the resident but this can be overwritten if required). The "Transaction Code" field is for the DD collection code (e.g. '17' is the code for a regular collection).

When all of the required data has been entered click on the green "Tick" to save the record and then move on to the Charges tab.

N.B. If you have selected the "Allow individual sales invoices to be posted to separate Sage datasets instead of homes" option on the System Defaults "Sage Invoice Posting" tab, another field will appear at the bottom of this screen.

You must select the relevant Sage dataset for this charge template in order to be able to select Sage Customer Codes, Nominal Codes, Department Code and VAT Codes.

There are two other buttons at the top of this screen:

The "Ad-Hoc Invoice/Credit Note" button.

The "Convert a Rate" button.